The UK, a leading trading power and financial center, is the third largest economy in Europe after Germany and France. Over the past two decades, the government has greatly reduced public ownership and contained the growth of social welfare programs. Agriculture is intensive, highly mechanized, and efficient by European standards, producing about 60% of food needs with less than 2% of the labor force. The UK has large coal, natural gas, and oil resources, but its oil and natural gas reserves are declining and the UK became a net importer of energy in 2005. Services, particularly banking, insurance, and business services, account by far for the largest proportion of GDP while industry continues to decline in importance. After emerging from recession in 1992, Britain's economy enjoyed the longest period of expansion on record during which time growth outpaced most of Western Europe. In 2008, however, the global financial crisis hit the economy particularly hard, due to the importance of its financial sector. Sharply declining home prices, high consumer debt, and the global economic slowdown compounded Britain's economic problems, pushing the economy into recession in the latter half of 2008 and prompting the then BROWN (Labour) government to implement a number of measures to stimulate the economy and stabilize the financial markets; these include nationalizing parts of the banking system, temporarily cutting taxes, suspending public sector borrowing rules, and moving forward public spending on capital projects. Facing burgeoning public deficits and debt levels, in 2010 the CAMERON-led coalition government (between Conservatives and Liberal Democrats) initiated a five-year austerity program, which aims to lower London's budget deficit from over 10% of GDP in 2010 to nearly 1% by 2015. In November 2011, Chancellor of the Exchequer George OSBORNE announced additional austerity measures through 2017 because of slower-than-expected economic growth and the impact of the euro-zone debt crisis. The CAMERON government raised the value added tax from 17.5% to 20% in 2011. It has pledged to reduce the corporation tax rate to 23% by 2015. The Bank of England (BoE) implemented an asset purchase program of up to ?325 billion (approximately $525 billion) as of February 2011. During times of economic crisis, the BoE coordinates interest rate moves with the European Central Bank, but Britain remains outside the European Economic and Monetary Union (EMU).

GDP (purchasing power parity)

$2.25 trillion (2011 est.)

$2.225 trillion (2010 est.)

$2.195 trillion (2009 est.)

note: data are in 2011 US dollars

GDP (official exchange rate)

$2.481 trillion (2011 est.)

GDP - real growth rate

1.1% (2011 est.)

1.4% (2010 est.)

-4.4% (2009)

GDP - per capita (PPP)

$35,900 (2011 est.)

$35,800 (2010 est.)

$35,500 (2009 est.)

note: data are in 2011 US dollars

GDP - composition by sector

agriculture: 0.7%

industry: 21.4%

services: 77.8% (2011 est.)

Population below poverty line

14% (2006 est.)

Labor force

31.73 million (2011 est.)

Labor force - by occupation

agriculture: 1.4%

industry: 18.2%

services: 80.4% (2006 est.)

Unemployment rate

8.1% (2011 est.)

7.8% (2010 est.)

Unemployment, youth ages 15-24

total: 18.9%

male: 21.7%

female: 15.6% (2009)

Household income or consumption by percentage share

lowest 10%: 2.1%

highest 10%: 28.5% (1999)

Distribution of family income - Gini index

34 (2005)

36.8 (1999)

Investment (gross fixed)

14.3% of GDP (2011 est.)

Budget

revenues: $986.5 billion

expenditures: $1.188 trillion (2011 est.)

Taxes and other revenues

40.9% of GDP (2011 est.)

Budget surplus (+) or deficit (-)

-8.8% of GDP (2011 est.)

Public debt

79.5% of GDP (2011 est.)

76.1% of GDP (2010 est.)

note: data cover general government debt, and includes debt instruments issued (or owned) by government entities other than the treasury; the data include treasury debt held by foreign entities; the data include debt issued by subnational entities, as well as intra-governmental debt; intra-governmental debt consists of treasury borrowings from surpluses in the social funds, such as for retirement, medical care, and unemployment. Debt instruments for the social funds are not sold at public auctions.

Inflation rate (consumer prices)

4.5% (2011 est.)

3.3% (2010 est.)

Central bank discount rate

7.75% (31 December 2010 est.)

0.5% (31 December 2009 est.)

Commercial bank prime lending rate

4% (31 December 2011 est.)

3.962% (31 December 2010 est.)

Stock of money

$NA

Stock of narrow money

$96.55 billion (31 December 2011 est.)

$88.88 billion (31 December 2010 est.)

Stock of quasi money

$NA

Stock of broad money

$3.53 trillion (31 December 2011 est.)

$3.362 trillion (31 December 2010 est.)

Stock of domestic credit

$5.151 trillion (31 December 2009)

$4.436 trillion (31 December 2008)

Market value of publicly traded shares

$3.107 trillion (31 December 2010)

$2.796 trillion (31 December 2009)

$1.852 trillion (31 December 2008)

Agriculture - products

cereals, oilseed, potatoes, vegetables; cattle, sheep, poultry; fish

Industries

machine tools, electric power equipment, automation equipment, railroad equipment, shipbuilding, aircraft, motor vehicles and parts, electronics and communications equipment, metals, chemicals, coal, petroleum, paper and paper products, food processing, textiles, clothing, other consumer goods

Industrial production growth rate

-1.2% (2011 est.)

Electricity - production

346 billion kWh (2009 est.)

Electricity - production by source

fossil fuel: 73.8%

hydro: 0.9%

nuclear: 23.7%

other: 1.6% (2001)

Electricity - consumption

344.7 billion kWh (2008 est.)

Electricity - exports

3.748 billion kWh (2009 est.)

Electricity - imports

2.861 billion kWh (2009 est.)

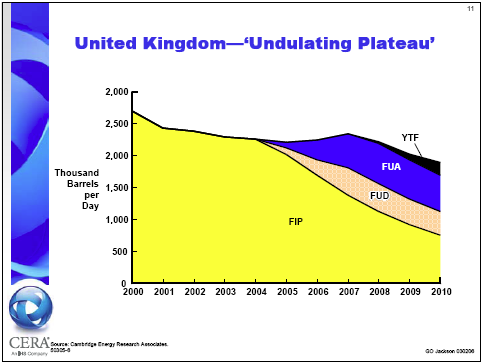

Oil - production

1.393 million bbl/day (2010 est.)

Oil - consumption

1.622 million bbl/day (2010 est.)

Oil - exports

1.311 million bbl/day (2009 est.)

Oil - imports

1.45 million bbl/day (2009 est.)

Oil - proved reserves

2.858 billion bbl (1 January 2011 est.)

Natural gas - production

56.3 billion cu m (2010 est.)

Natural gas - consumption

94.28 billion cu m (2010 est.)

Natural gas - exports

15.65 billion cu m (2010 est.)

Natural gas - imports

53.63 billion cu m (2010 est.)

Natural gas - proved reserves

256 billion cu m (1 January 2011 est.)

Current Account Balance

-$66.6 billion (2011 est.)

-$71.6 billion (2010 est.)

Exports

$495.4 billion (2011 est.)

$410.2 billion (2010 est.)

Exports - commodities

manufactured goods, fuels, chemicals; food, beverages, tobacco

Exports - partners

US 11.4%, Germany 11.2%, Netherlands 8.5%, France 7.7%, Ireland 6.8%, Belgium 5.4% (2009)

Imports

$654.9 billion (2011 est.)

$563.2 billion (2010 est.)

Imports - commodities

manufactured goods, machinery, fuels; foodstuffs

Imports - partners

Germany 13.1%, China 9.1%, Netherlands 7.5%, France 6.1%, US 5.8%, Norway 5.5%, Belgium 4.9% (2009)

Reserves of foreign exchange and gold

$82.41 billion (31 December 2010 est.)

$66.72 billion (31 December 2009 est.)

Debt - external

$9.836 trillion (30 June 2011)

$8.981 trillion (30 June 2010)

Stock of direct foreign investment - at home

$1.136 trillion (31 December 2011 est.)

$1.076 trillion (31 December 2010 est.)

Stock of direct foreign investment - abroad

$1.702 trillion (31 December 2011 est.)

$1.675 trillion (31 December 2010 est.)

No comments:

Post a Comment