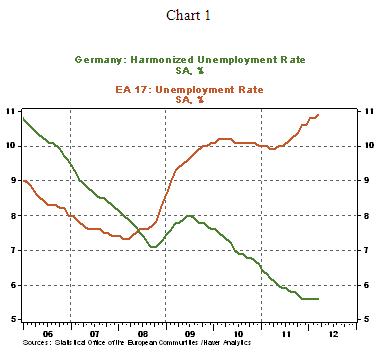

The German economy - the fifth largest economy in the world in PPP terms and Europe's largest - is a leading exporter of machinery, vehicles, chemicals, and household equipment and benefits from a highly skilled labor force. Like its Western European neighbors, Germany faces significant demographic challenges to sustained long-term growth. Low fertility rates and declining net immigration are increasing pressure on the country's social welfare system and necessitate structural reforms. Reforms launched by the government of Chancellor Gerhard SCHROEDER (1998-2005), deemed necessary to address chronically high unemployment and low average growth, contributed to strong growth in 2006 and 2007 and falling unemployment. These advances, as well as a government subsidized, reduced working hour scheme, help explain the relatively modest increase in unemployment during the 2008-09 recession - the deepest since World War II - and its decrease to 6.0% in 2011. GDP contracted 5.1% in 2009 but grew by 3.6% in 2010, and 2.7% in 2011. The recovery was attributable primarily to rebounding manufacturing orders and exports - increasingly outside the Euro Zone. Germany's central bank projects that GDP will grow 0.6% in 2012, a reflection of the worsening euro-zone financial crisis and the financial burden it places on Germany as well as falling demand for German exports. Domestic demand is therefore becoming a more significant driver of Germany's economic expansion. Stimulus and stabilization efforts initiated in 2008 and 2009 and tax cuts introduced in Chancellor Angela MERKEL's second term increased Germany's budget deficit to 3.3% in 2010, but slower spending and higher tax revenues reduce the deficit to 1.7% in 2011, below the EU's 3% limit. A constitutional amendment approved in 2009 limits the federal government to structural deficits of no more than 0.35% of GDP per annum as of 2016. Following the March 2011 Fukushima nuclear disaster, Chancellor Angela Merkel announced in May 2011 that eight of the country's 17 nuclear reactors would be shut down immediately and the remaining plants would close by 2022. Germany hopes to replace nuclear power with renewable energy. Before the shutdown of the eight reactors, Germany relied on nuclear power for 23% of its energy and 46% of its base-load electrical production.

GDP (purchasing power parity)

$3.085 trillion (2011 est.)

$3.003 trillion (2010 est.)

$2.9 trillion (2009 est.)

note: data are in 2011 US dollars

GDP (official exchange rate)

$3.629 trillion (2011 est.)

GDP - real growth rate

2.7% (2011 est.)

3.6% (2010 est.)

-5.1% (2009 est.)

GDP - per capita (PPP)

$37,900 (2011 est.)

$36,800 (2010 est.)

$35,500 (2009 est.)

note: data are in 2011 US dollars

GDP - composition by sector

agriculture: 0.8%

industry: 28.6%

services: 70.6% (2011 est.)

Population below poverty line

15.5% (2010 est.)

Labor force

43.62 million (2011 est.)

Labor force - by occupation

agriculture: 1.6%

industry: 24.6%

services: 73.8% (2011)

Unemployment rate

6% (2011 est.)

6.8% (2010 est.)

note: this is the International Labor Organization's rate for international comparisons; Germany's Federal Employment Agency reported an annual average unemployment rate of 7.1% for 2011 and 7.7% for 2010.

Unemployment, youth ages 15-24

total: 11%

male: 12%

female: 9.8% (2009)

Household income or consumption by percentage share

lowest 10%: 3.6%

highest 10%: 24% (2000)

Distribution of family income - Gini index

27 (2006)

30 (1994)

Investment (gross fixed)

18.2% of GDP (2011 est.)

Budget

revenues: $1.551 trillion

expenditures: $1.588 trillion (2011 est.)

Taxes and other revenues

43.6% of GDP (2011 est.)

Budget surplus (+) or deficit (-)

-1.7% of GDP (2011 est.)

Public debt

81.5% of GDP (2011 est.)

83.4% of GDP (2010 est.)

note: general government gross debt is defined in the Maastricht Treaty as consolidated general government gross debt at nominal value, outstanding at the end of the year in the following categories of government liabilities (as defined in ESA95): currency and deposits (AF.2), securities other than shares excluding financial derivatives (AF.3, excluding AF.34), and loans (AF.4); the general government sector comprises the sub-sectors of central government, state government, local government and social security funds; the series are presented as a percentage of GDP and in millions of euro; GDP used as a denominator is the gross domestic product at current market prices; data expressed in national currency are converted into euro using end-year exchange rates provided by the European Central Bank

Inflation rate (consumer prices)

2.2% (2011 est.)

1.1% (2010 est.)

Central bank discount rate

1.75% (31 December 2011)

1.75% (31 December 2010)

note: this is the European Central Bank's rate on the marginal lending facility, which offers overnight credit to banks in the euro area

Commercial bank prime lending rate

8.4% (31 December 2011 est.)

4.96% (31 December 2009 est.)

Stock of narrow money

$1.831 trillion (31 December 2011 est.)

$1.747 trillion (31 December 2010 est.)

note: see entry for the European Union for money supply in the euro area; the European Central Bank (ECB) controls monetary policy for the 17 members of the Economic and Monetary Union (EMU); individual members of the EMU do not control the quantity of money circulating within their own borders

Stock of money

$NA

note: see entry for the European Union for money supply in the euro area; the European Central Bank (ECB) controls monetary policy for the 16 members of the Economic and Monetary Union (EMU); individual members of the EMU do not control the quantity of money and quasi money circulating within their own borders

Stock of quasi money

$NA

Stock of broad money

$4.437 trillion (31 December 2011 est.)

$4.173 trillion (31 December 2010 est.)

Stock of domestic credit

$4.689 trillion (31 December 2011 est.)

$5.2 trillion (31 December 2009 est.)

Market value of publicly traded shares

$1.43 trillion (31 December 2010)

$1.298 trillion (31 December 2009)

$1.108 trillion (31 December 2008)

Agriculture - products

potatoes, wheat, barley, sugar beets, fruit, cabbages; cattle, pigs, poultry

Industries

among the world's largest and most technologically advanced producers of iron, steel, coal, cement, chemicals, machinery, vehicles, machine tools, electronics, food and beverages, shipbuilding, textiles

Industrial production growth rate

8% (2011 est.)

Electricity - production

556.4 billion kWh (2009 est.)

Electricity - production by source

fossil fuel: 61.8%

hydro: 4.2%

nuclear: 29.9%

other: 4.1% (2001)

Electricity - consumption

544.5 billion kWh (2008 est.)

Electricity - exports

54.13 billion kWh (2009 est.)

Electricity - imports

12.28 billion kWh (2009 est.)

Oil - production

147,200 bbl/day (2010 est.)

Oil - consumption

2.495 million bbl/day (2010 est.)

Oil - exports

470,200 bbl/day (2009 est.)

Oil - imports

2.671 million bbl/day (2009 est.)

Oil - proved reserves

276 million bbl (1 January 2011 est.)

Natural gas - production

12.65 billion cu m (2010 est.)

Natural gas - consumption

99.5 billion cu m (2010 est.)

Natural gas - exports

16.19 billion cu m (2010 est.)

Natural gas - imports

99.63 billion cu m (2010 est.)

Natural gas - proved reserves

175.6 billion cu m (1 January 2011 est.)

Current Account Balance

$149.3 billion (2011 est.)

$188.4 billion (2010 est.)

Exports

$1.408 trillion (2011 est.)

$1.264 trillion (2010 est.)

Exports - commodities

motor vehicles, machinery, chemicals, computer and electronic products, electrical equipment, pharmaceuticals, metals, transport equipment, foodstuffs, textiles, rubber and plastic products

Exports - partners

France 9.4%, US 6.8%, Netherlands 6.6%, UK 6.2%, Italy 6.2%, China 5.7%, Austria 5.5%, Belgium 4.7%, Switzerland 4.4% (2009 est.)

Imports

$1.198 trillion (2011 est.)

$1.058 trillion (2010 est.)

Imports - commodities

machinery, data processing equipment, vehicles, chemicals, oil and gas, metals, electric equipment, pharmaceuticals, foodstuffs, agricultural products

Imports - partners

China 9.7%, Netherlands 8.4%, France 7.6%, US 5.7%, Italy 5.2%, UK 4.7%, Belgium 4.2%, Austria 4.1%, Switzerland 4.1% (2009 est.)

Reserves of foreign exchange and gold

$216.5 billion (31 December 2010 est.)

Debt - external

$5.624 trillion (30 June 2011)

$4.713 trillion (30 June 2010)

Stock of direct foreign investment - at home

$998.1 billion (31 December 2011 est.)

$956.6 billion (31 December 2010 est.)

Stock of direct foreign investment - abroad

$1.486 trillion (31 December 2011 est.)

$1.427 trillion (31 December 2010 est.)

No comments:

Post a Comment